Tax Form Rut50 Printable

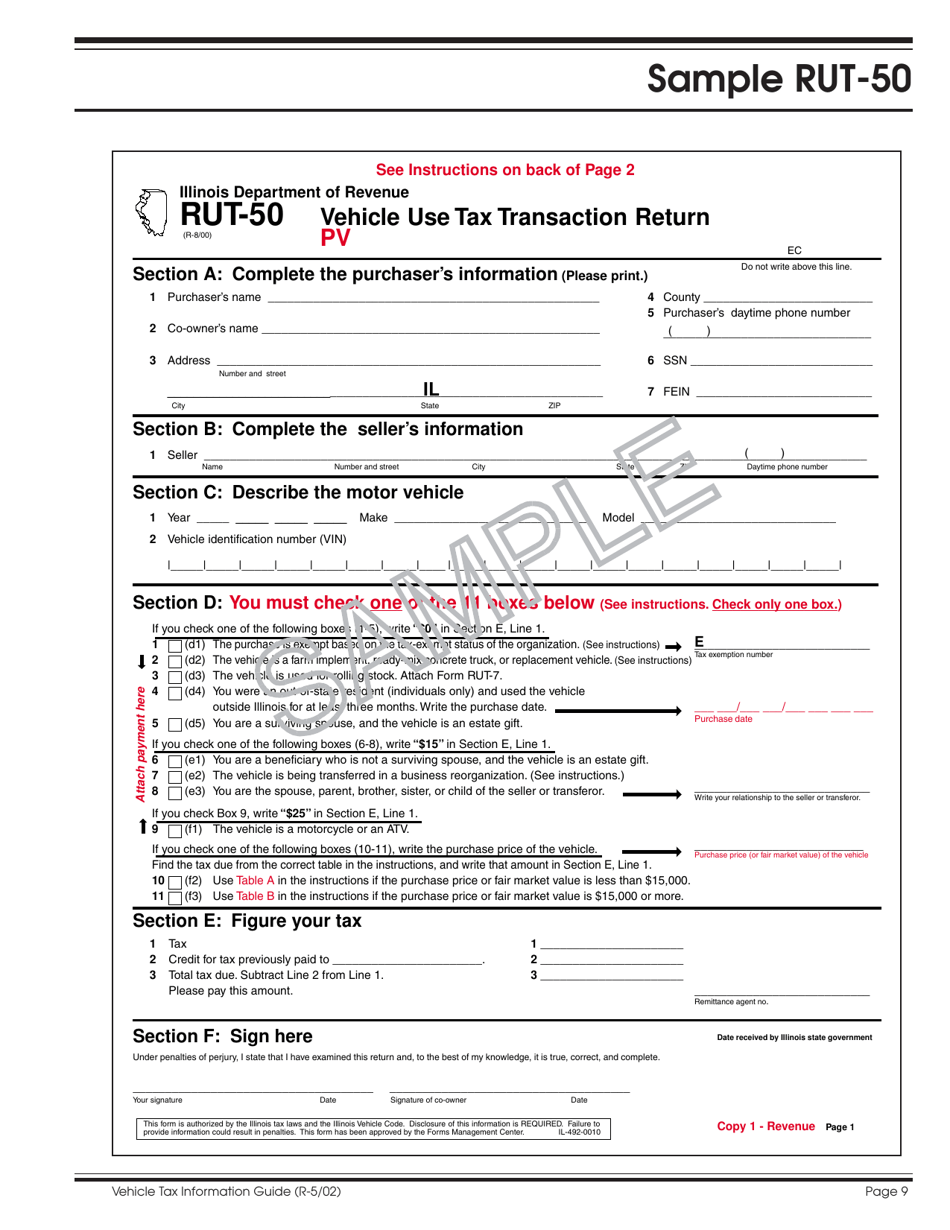

Tax Form Rut50 Printable - This ensures compliance with state tax laws for all vehicle transactions. If your address for vehicle registration or titling is within a local government that. It is not entered on the federal or illinois tax form. It serves as a crucial. You must also amount you are paying: Do not make copies of the. The form calculates the amount of private party vehicle use tax that must be paid. For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). Fill online or download as pdf or word document for free. Use the use tax rate table in the tax rate database to determine your tax liability. Use the use tax rate table in the tax rate database to determine your tax liability. Enter your illinois private party vehicle use tax due, as determined in step 4 or step 5. The form calculates the amount of private party vehicle use tax that must be paid. Tax return for vehicle leasing companies (updated to include changes effective january 1, 2025.) lease/rental payments for certain titled or registered property (updated. Fill online or download as pdf or word document for free. In other words, you should file this form if you purchased or. This ensures compliance with state tax laws for all vehicle transactions. It is not entered on the federal or illinois tax form. If your address for vehicle registration or titling is within a local government that. You must also amount you are paying: It is not entered on the federal or illinois tax form. If your address for vehicle registration or titling is within a local government that. It serves as a crucial. Fill online or download as pdf or word document for free. Tax return for vehicle leasing companies (updated to include changes effective january 1, 2025.) lease/rental payments for certain titled. If your address for vehicle registration or titling is within a local government that. The form calculates the amount of private party vehicle use tax that must be paid. Do not make copies of the. Enter your illinois private party vehicle use tax due, as determined in step 4 or step 5. It serves as a crucial. Tax return for vehicle leasing companies (updated to include changes effective january 1, 2025.) lease/rental payments for certain titled or registered property (updated. It serves as a crucial. Fill online or download as pdf or word document for free. Enter your illinois private party vehicle use tax due, as determined in step 4 or step 5. Do not make copies. Fill online or download as pdf or word document for free. You must also amount you are paying: This ensures compliance with state tax laws for all vehicle transactions. It is not entered on the federal or illinois tax form. It serves as a crucial. Fill online or download as pdf or word document for free. It is not entered on the federal or illinois tax form. For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). Use the use tax rate table in the tax. You must also amount you are paying: Use the use tax rate table in the tax rate database to determine your tax liability. Enter your illinois private party vehicle use tax due, as determined in step 4 or step 5. For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with. Fill online or download as pdf or word document for free. For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). Do not make copies of the. This ensures compliance with state tax laws for all vehicle transactions. You must also. It serves as a crucial. You must also amount you are paying: For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). Enter your illinois private party vehicle use tax due, as determined in step 4 or step 5. Fill online. For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). Use the use tax rate table in the tax rate database to determine your tax liability. This ensures compliance with state tax laws for all vehicle transactions. In other words, you. Use the use tax rate table in the tax rate database to determine your tax liability. Do not make copies of the. The form calculates the amount of private party vehicle use tax that must be paid. You must also amount you are paying: Fill online or download as pdf or word document for free. Enter your illinois private party vehicle use tax due, as determined in step 4 or step 5. For illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). If your address for vehicle registration or titling is within a local government that. It is not entered on the federal or illinois tax form. Do not make copies of the. You must also amount you are paying: In other words, you should file this form if you purchased or. Do not make copies of the. It serves as a crucial. Use the use tax rate table in the tax rate database to determine your tax liability. Fill online or download as pdf or word document for free.Tax Form Rut50 Printable Printable Word Searches

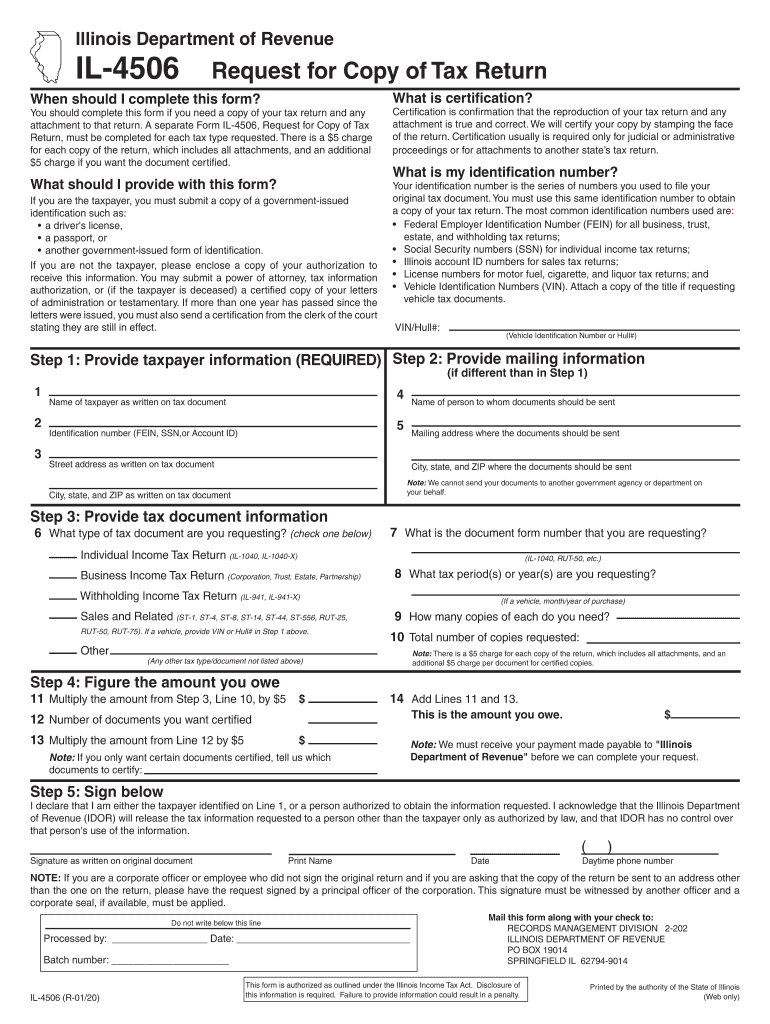

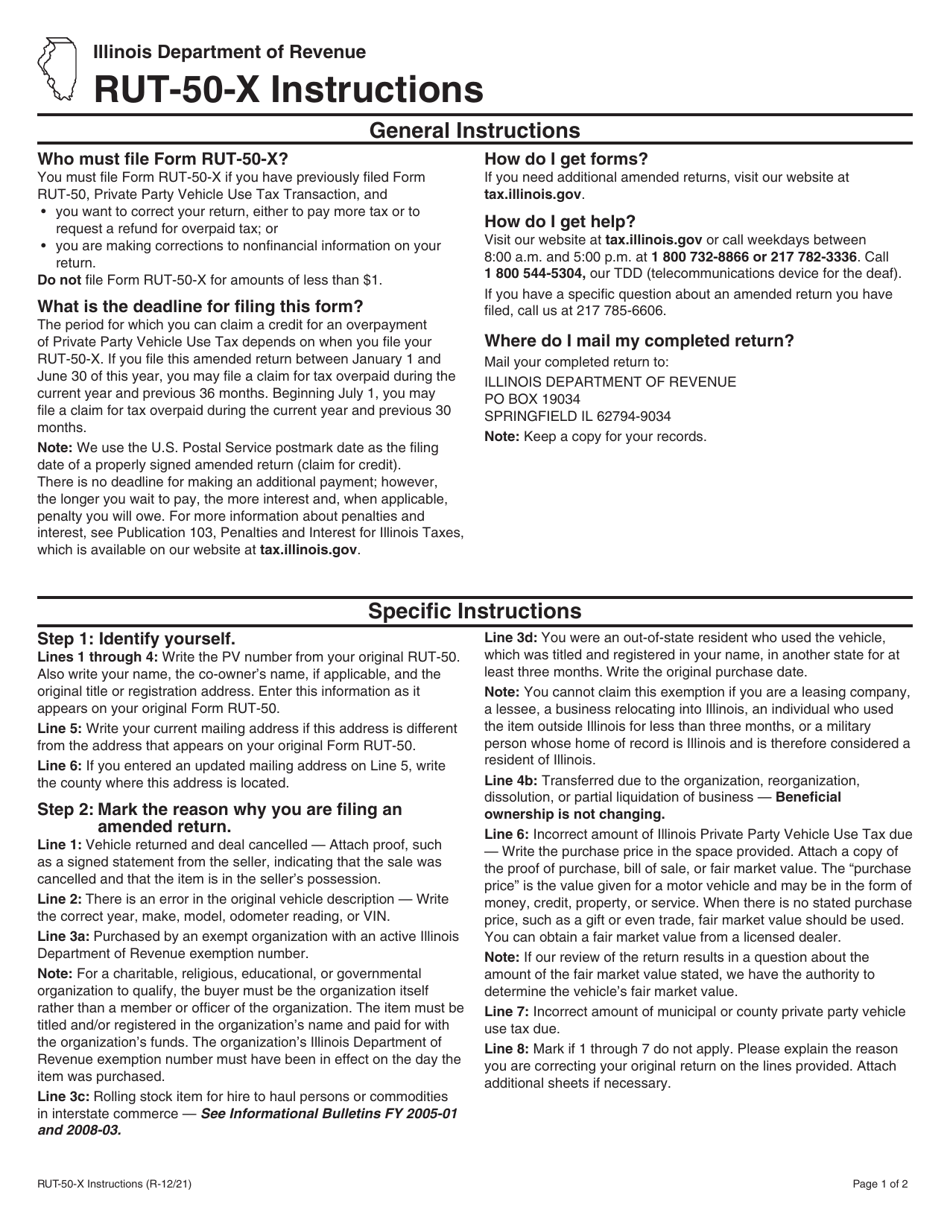

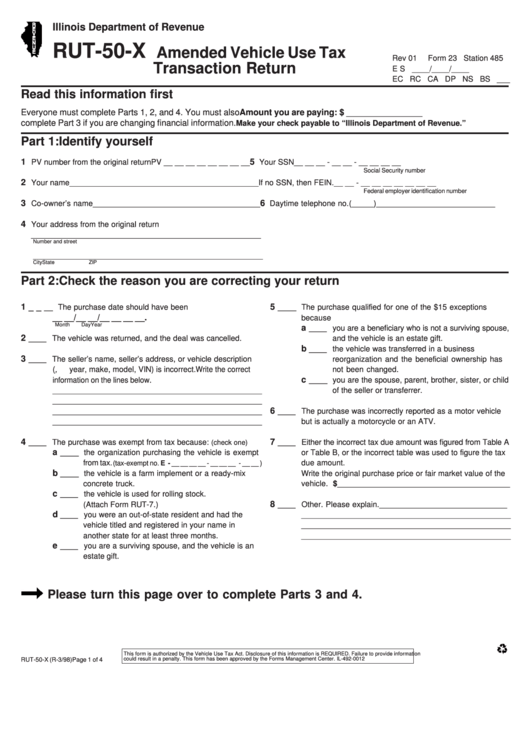

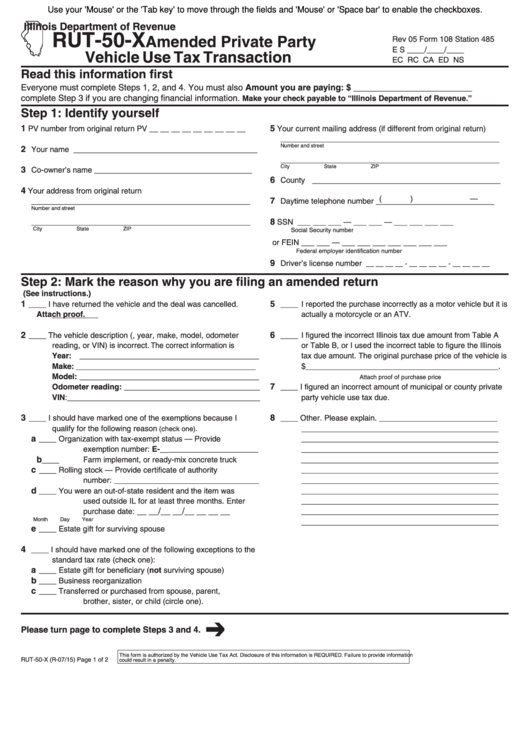

Download Instructions for Form RUT50X, 108 Amended Private Party

Download Instructions for Form RUT50X Amended Private Party Vehicle

Rut50 Printable Form Free Printable

Sample Form RUT50 Fill Out, Sign Online and Download Printable PDF

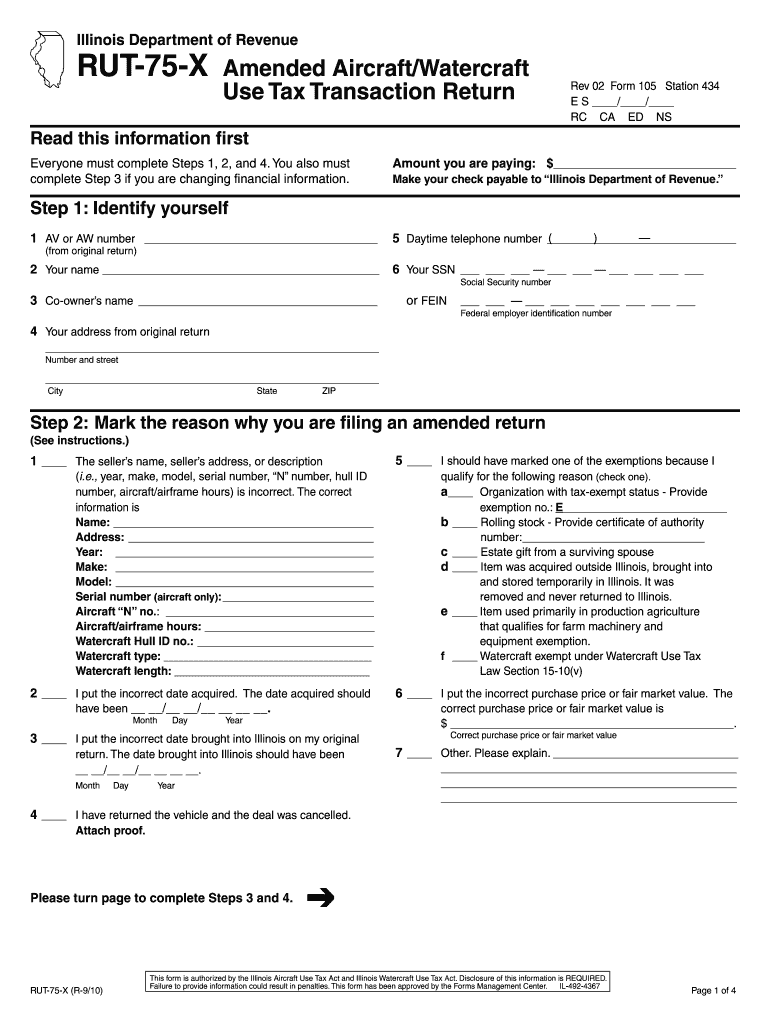

IL RUT75X 2010 Fill out Tax Template Online US Legal Forms

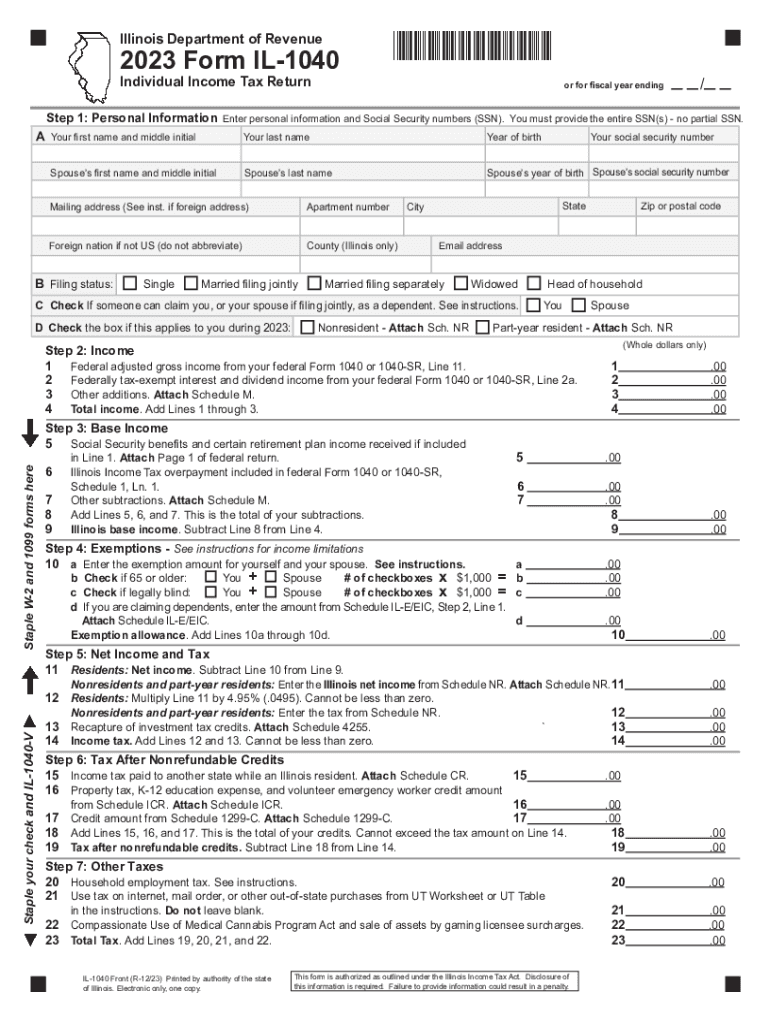

State of Illinois Taxes 20232025 Form Fill Out and Sign Printable

Rut50 Printable Form

What Is Rut50 Vehicle Tax

Fillable Online Sample Form RUT50 Vehicle Use Tax Transaction Return

The Form Calculates The Amount Of Private Party Vehicle Use Tax That Must Be Paid.

Tax Return For Vehicle Leasing Companies (Updated To Include Changes Effective January 1, 2025.) Lease/Rental Payments For Certain Titled Or Registered Property (Updated.

This Ensures Compliance With State Tax Laws For All Vehicle Transactions.

Related Post: