Goodwill Itemized Donation List Printable

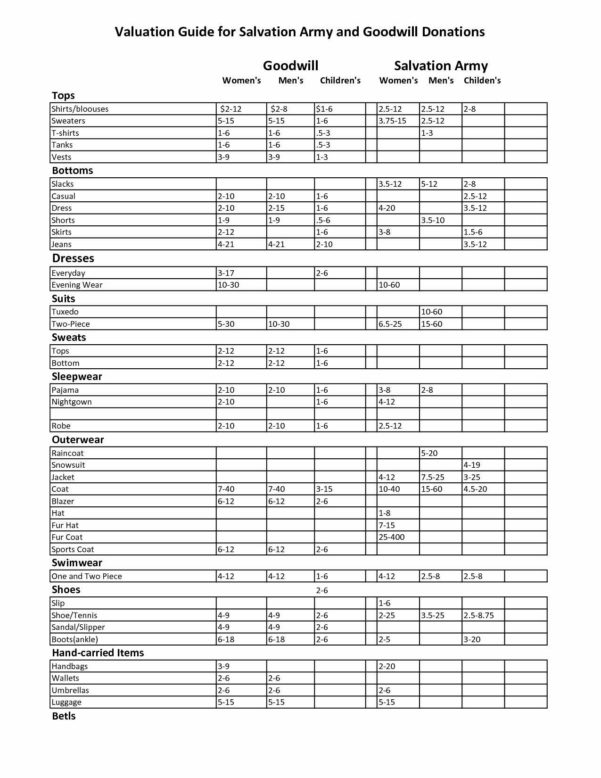

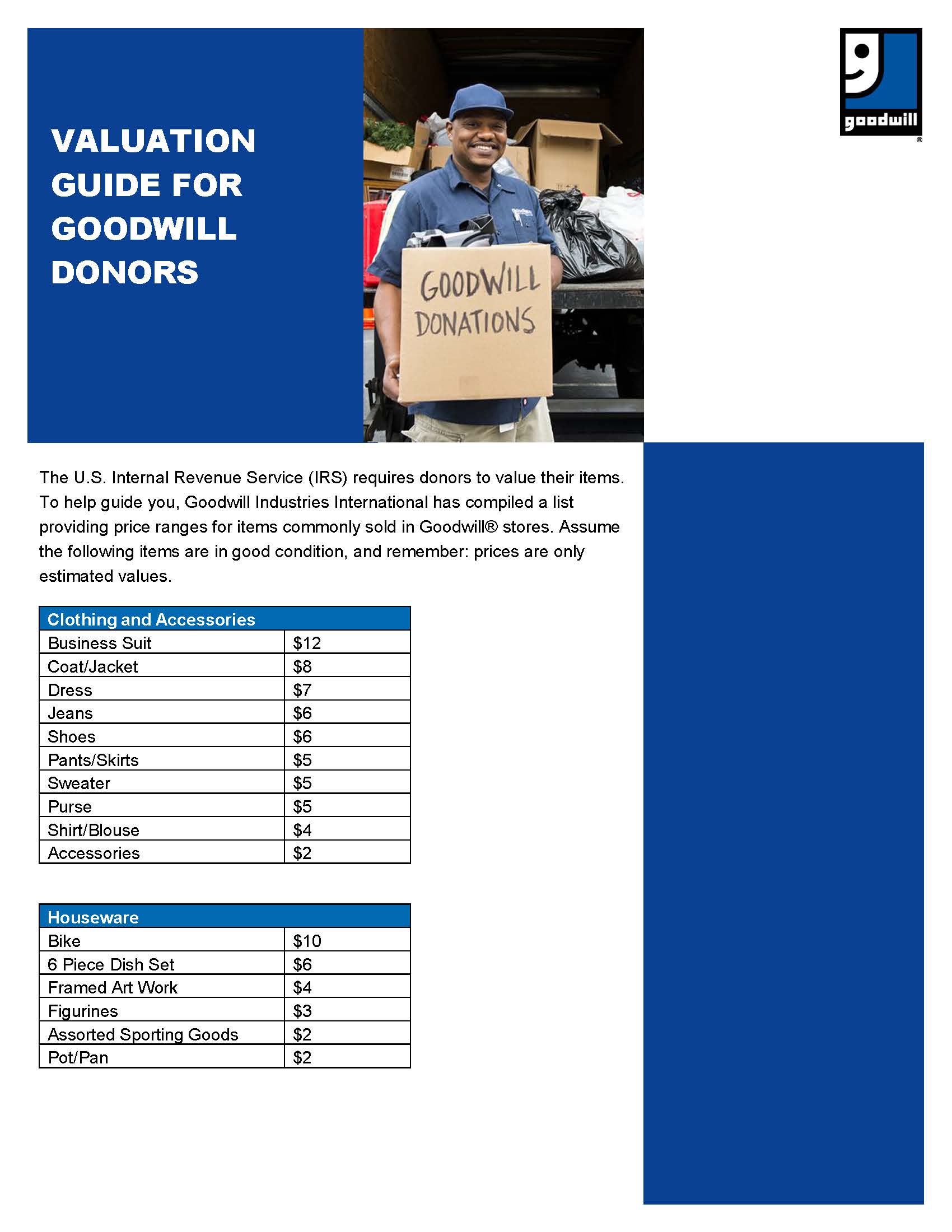

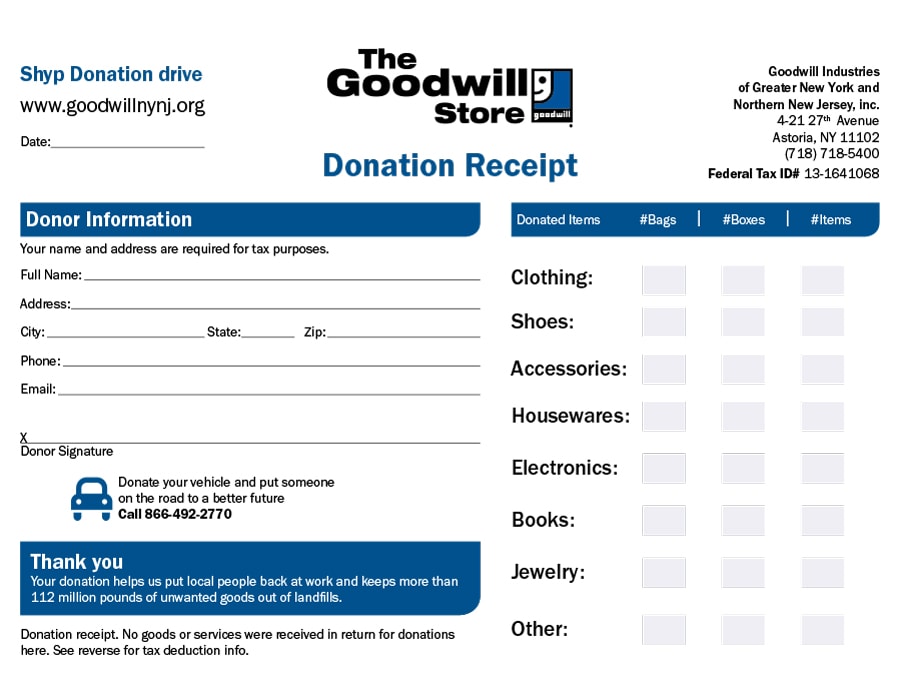

Goodwill Itemized Donation List Printable - Internal revenue service (irs) requires donors to value their items. Internal revenue service (irs) requires donors to value their items. Estimate the value of your donations automatically with this handy donation calculator and receipt form. To help guide you, goodwill has compiled a list providing price ranges for items commonly sold in goodwill stores. This guide provides low and high ranges for clothing, household goods, sporting goods, miscellaneous and. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. By assisting in assessing the condition and worth of items, this guide. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. After you make a donation to goodwill, ask for a donation receipt. Need help determining the value of your donation for tax purposes? Need help determining the value of your donation for tax purposes? You, the donor, must determine the fair market value of those donations. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Once filled out, present it to the goodwill employee receiving your donations and have them fill. Internal revenue service (irs) requires donors to value their items. Internal revenue service (irs) requires donors to value their items. What is my donation worth? The internal revenue service (irs) requires that all charitable donations be itemized and valued. The irs requires donors to value their items, and this list will help guide you. There are three pages to the printable, click the image to open the printable, then print or save it. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Once filled out, present it to the goodwill employee receiving your donations and have them fill. Assume the following items are in good condition, and remember, prices are. This guide provides low and high ranges for clothing, household goods, sporting goods, miscellaneous and.. Use this receipt when filing your taxes. You, the donor, must determine the fair market value of those donations. Estimate the value of your donations automatically with this handy donation calculator and receipt form. Access online donor feedback form. There are three pages to the printable, click the image to open the printable, then print or save it. Once filled out, present it to the goodwill employee receiving your donations and have them fill. This guide provides low and high ranges for clothing, household goods, sporting goods, miscellaneous and. To help guide you, goodwill industries international has. Access online donor feedback form. A donation receipt is an itemized list of the items that you donated, that includes the. This guide provides low and high ranges for clothing, household goods, sporting goods, miscellaneous and. Assume the following items are in good condition, and remember, prices are. The irs requires donors to value their items, and this list will help guide you. There are three pages to the printable, click the image to open the printable, then print or save. Internal revenue service (irs) requires donors to value their items. The first is a valuation guide to see what your items are worth. Download the receipt template on this page, and fill it out using the goodwill valuation guide. This guide provides low and high ranges for clothing, household goods, sporting goods, miscellaneous and. The internal revenue service (irs) requires. Once filled out, present it to the goodwill employee receiving your donations and have them fill. Estimate the value of your donations automatically with this handy donation calculator and receipt form. Find out how to estimate the value of your donated items for tax deductions. A donation receipt is an itemized list of the items that you donated, that includes. Estimate the value of your donations automatically with this handy donation calculator and receipt form. Download the receipt template on this page, and fill it out using the goodwill valuation guide. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market. Find out how to value your donated items for tax. After you make a donation to goodwill, ask for a donation receipt. Find out how to value your donated items for tax deduction purposes with this guide from goodwill industries international. Use this receipt when filing your taxes. You, the donor, must determine the fair market value of those donations. The internal revenue service (irs) requires that all charitable donations. Assume the following items are in good condition, and remember, prices are. See price ranges for clothing, household, and miscellaneous items. You, the donor, must determine the fair market value of those donations. Use this receipt when filing your taxes. To help guide you, goodwill has compiled a list providing price ranges for items commonly sold in goodwill stores. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Use this receipt when filing your taxes. Find out how to estimate the value of your donated items for tax deductions. You, the donor, must determine the fair market value of those donations. Download valuation guide for goodwill donors. Internal revenue service (irs) requires donors to value their items. There are three pages to the printable, click the image to open the printable, then print or save it. Find out how to estimate the value of your donated items for tax deductions. Download the receipt template on this page, and fill it out using the goodwill valuation guide. By assisting in assessing the condition and worth of items, this guide. Assume the following items are in good condition, and remember, prices are. You, the donor, must determine the fair market value of those donations. Simply enter the number of donated items into the form below to calculate the total value. Use the list below as a general guide to assess the “fair market value” you can claim on your. The irs requires donors to value their items, and this list will help guide you. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Internal revenue service (irs) requires donors to value their items. The first is a valuation guide to see what your items are worth. Use this receipt when filing your taxes. To help guide you, goodwill industries international has. What is my donation worth?Goodwill Donation Value Guide 2021 Worksheet

Itemized Donation List Printable 2023

Itemized List For Charitable Donations

Goodwill Itemized Donation List Printable

Salvation Army Valuation Guide 2022

Goodwill Itemized Donation List Printable

Donation Value Guide What is my Goodwill Donation Worth? Goodwill

Goodwill Itemized Donation List Printable

Goodwill Itemized Donation List Printable

Goodwill Itemized Donation List Printable

Need Help Determining The Value Of Your Donation For Tax Purposes?

Estimate The Value Of Your Donations Automatically With This Handy Donation Calculator And Receipt Form.

The Purpose Of This Form Is To Provide Donors With A Comprehensive Guide To Accurately Value Their Goodwill Donations.

Find Out How To Value Your Donated Items For Tax Deduction Purposes With This Guide From Goodwill Industries International.

Related Post: