Free Printable Tax Transcript

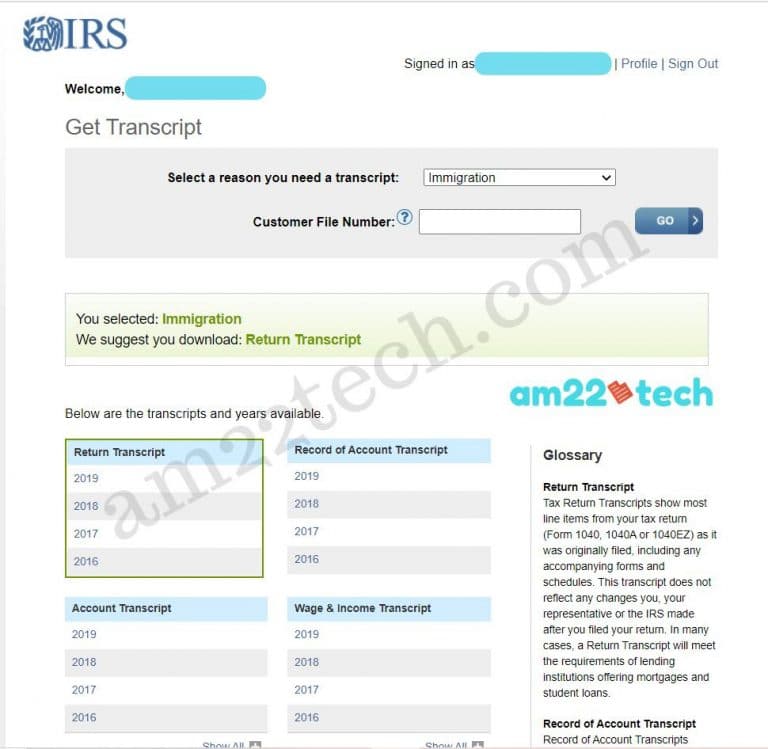

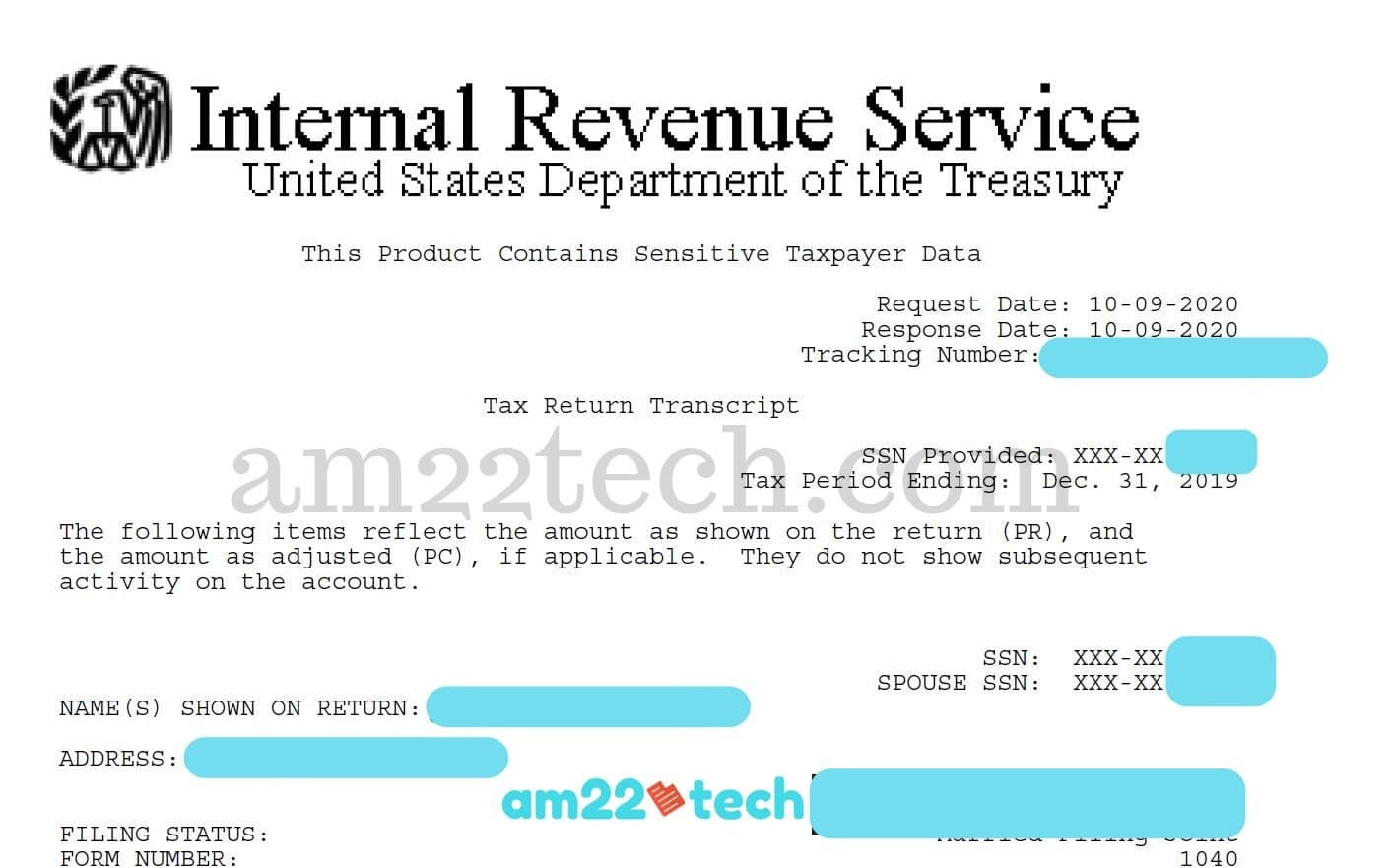

Free Printable Tax Transcript - You can request a transcript electronically through the irs. This form allows you to request a transcript of your tax return or other tax information from the irs. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation. For fast help, go online to www.irs.gov and click on get your. An official website of the united states government. There are 2 ways to get a business tax transcript: You can also get tax transcripts from the irs by making a request via. Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. Printing a copy of your old tax return on freetaxusa is free. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. There are 2 ways to get a business tax transcript: An official website of the united states government. The irs even has an online portal, which you can use to request either a pdf on your computer or a paper copy in. View, print or download it in your business tax account. Requesting a tax transcript is a simple and free process. Irs instructions help you get past year returns easily. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with the irs. For fast help, go online to www.irs.gov and click on get your. You can request a transcript electronically through the irs. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Find out the difference between transcripts and copies and when you may. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Requesting a tax transcript is a simple and free process. You can request a transcript electronically through the irs. The irs even has an online portal,. Requesting a transcript by mail is possible as well, but it can. An official website of the united states government. There are 2 ways to get a business tax transcript: Irs free file lets qualified taxpayers get free tax preparation, free electronic filing and free direct deposit of their federal tax refund, if they’re owed one,. Requesting a tax transcript. There are 2 ways to get a business tax transcript: Find out the difference between transcripts and copies and when you may. Requesting a tax transcript is a simple and free process. The irs even has an online portal, which you can use to request either a pdf on your computer or a paper copy in. An official website of. You can request a free tax transcript from the irs online through the get transcript tool on its website. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. Printing a copy of your old tax return on freetaxusa is free. Requesting a transcript by mail is possible as. View, print or download it in your business tax account. Requesting a tax transcript is a simple and free process. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Find out the difference between transcripts and copies and when you may. Learn the different types of tax. Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. Printing a copy of your old tax return on freetaxusa is free. You can easily get a free copy of your tax transcript by creating or logging into your online irs account. View, print or download it in your business tax account. The. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with the irs. This form allows you to request a transcript of your tax return or other tax information from the irs. You can also get tax transcripts from the irs by making a request via. An official website of the. You can easily get a free copy of your tax transcript by creating or logging into your online irs account. For fast help, go online to www.irs.gov and click on get your. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. You can choose from different types. How can i request a tax transcript? Requesting a transcript by mail is possible as well, but it can. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with. The irs even has an online portal, which you can use to request either a pdf on your computer or a paper copy in. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Printing a copy of your old tax return on freetaxusa is free. You can. Irs free file lets qualified taxpayers get free tax preparation, free electronic filing and free direct deposit of their federal tax refund, if they’re owed one,. You can request a transcript electronically through the irs. Get the tax account transcript for the agi shows basic tax return data such as filing status, taxable income, and payment types. Printing a copy of your old tax return on freetaxusa is free. View, print or download it in your business tax account. Learn the different types of tax return transcripts and how to order them including irs get transcript online or by mail. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with the irs. For fast help, go online to www.irs.gov and click on get your. An official website of the united states government. You can request a free tax transcript from the irs online through the get transcript tool on its website. You can choose from different types of transcripts, such as return, account, record,. Learn how to get a free transcript or a copy of your federal tax return online, by phone, or by mail. Transcripts are free and faster to obtain, while copies incur a fee and take longer to process. You can also get tax transcripts from the irs by making a request via. You can easily get a free copy of your tax transcript by creating or logging into your online irs account. Irs transcripts are best and most often used to validate past income and tax filing status for mortgage and other loan applications, and to help with tax preparation.How to get IRS Tax Transcript Online (for i485 Filing) USA

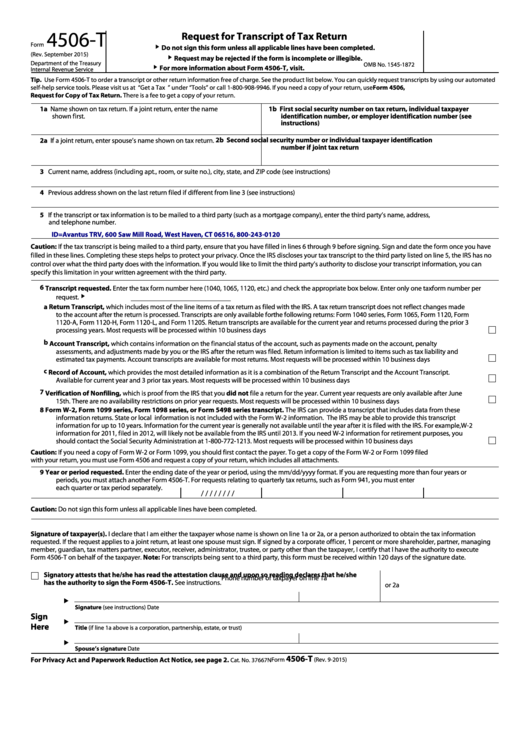

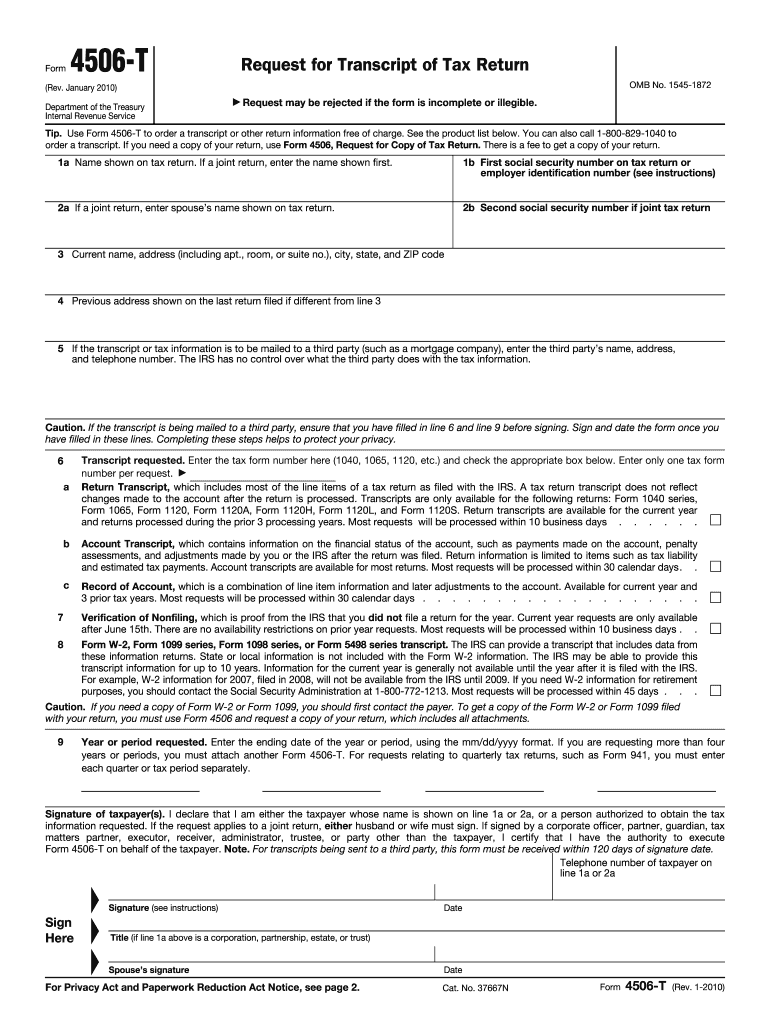

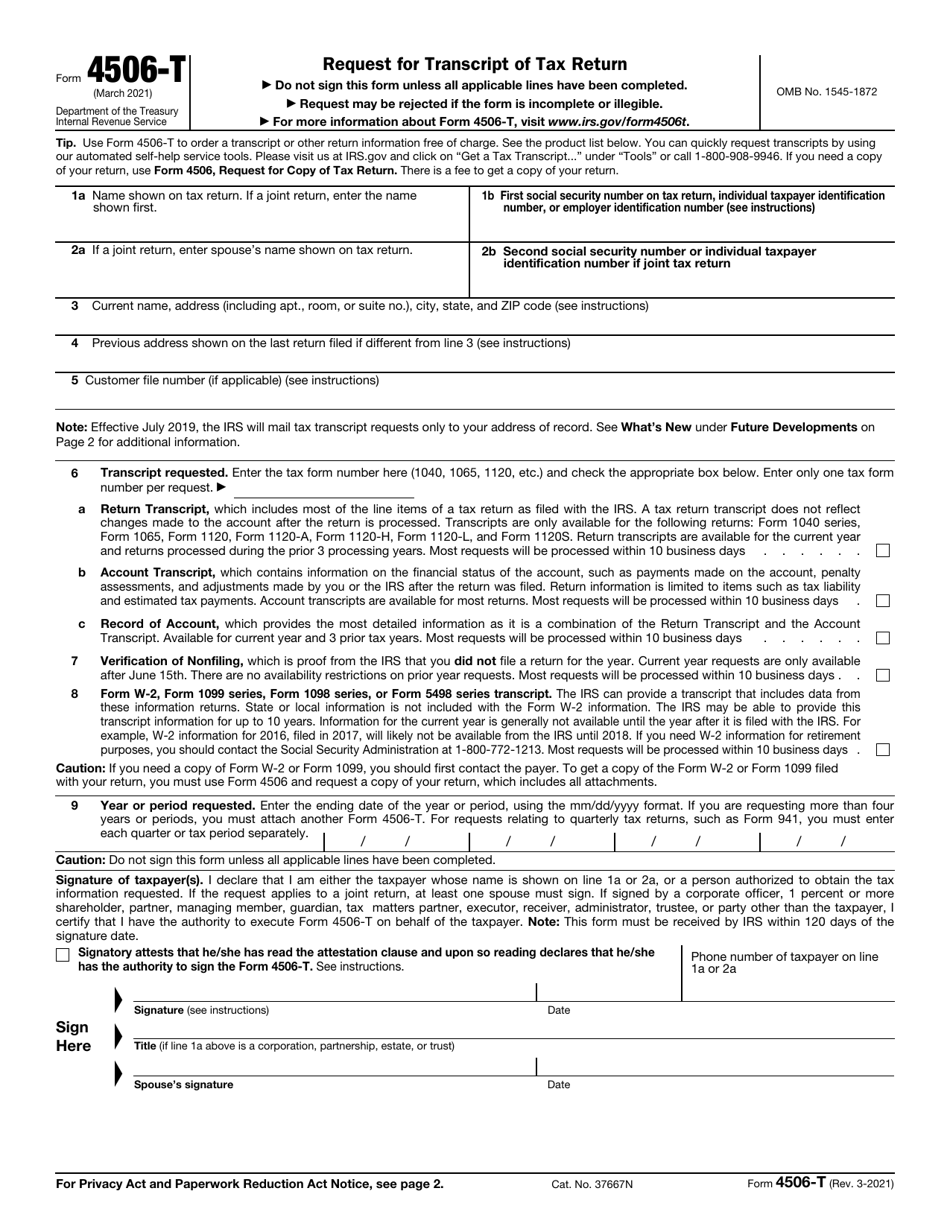

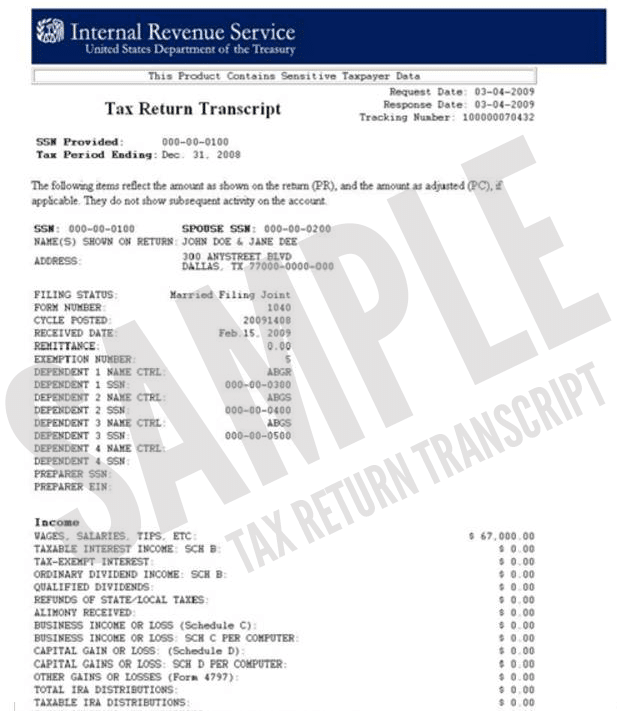

Fillable Form 4506T Request For Transcript Of Tax Return printable

Tax Return Transcript Example Fill Online, Printable, Fillable, Blank

Tax Transcript Decoder NHASFAA! Doc Template pdfFiller

4506 T Printable Form Printable Forms Free Online

Irs Form 4506 A Fillable Printable Forms Free Online

IRS Form 4506T Download Fillable PDF or Fill Online Request for

Fillable Online Tax Return Transcript 012345678 1120S YYYYMM COMP Fax

How To Get A Tax Return Transcript In 10 Minutes Shared Economy Tax

How to get IRS Tax Transcript Online (for i485 Filing) USA

How Can I Request A Tax Transcript?

This Form Allows You To Request A Transcript Of Your Tax Return Or Other Tax Information From The Irs.

It Also Shows Changes Made After Filing The.

Irs Instructions Help You Get Past Year Returns Easily.

Related Post: