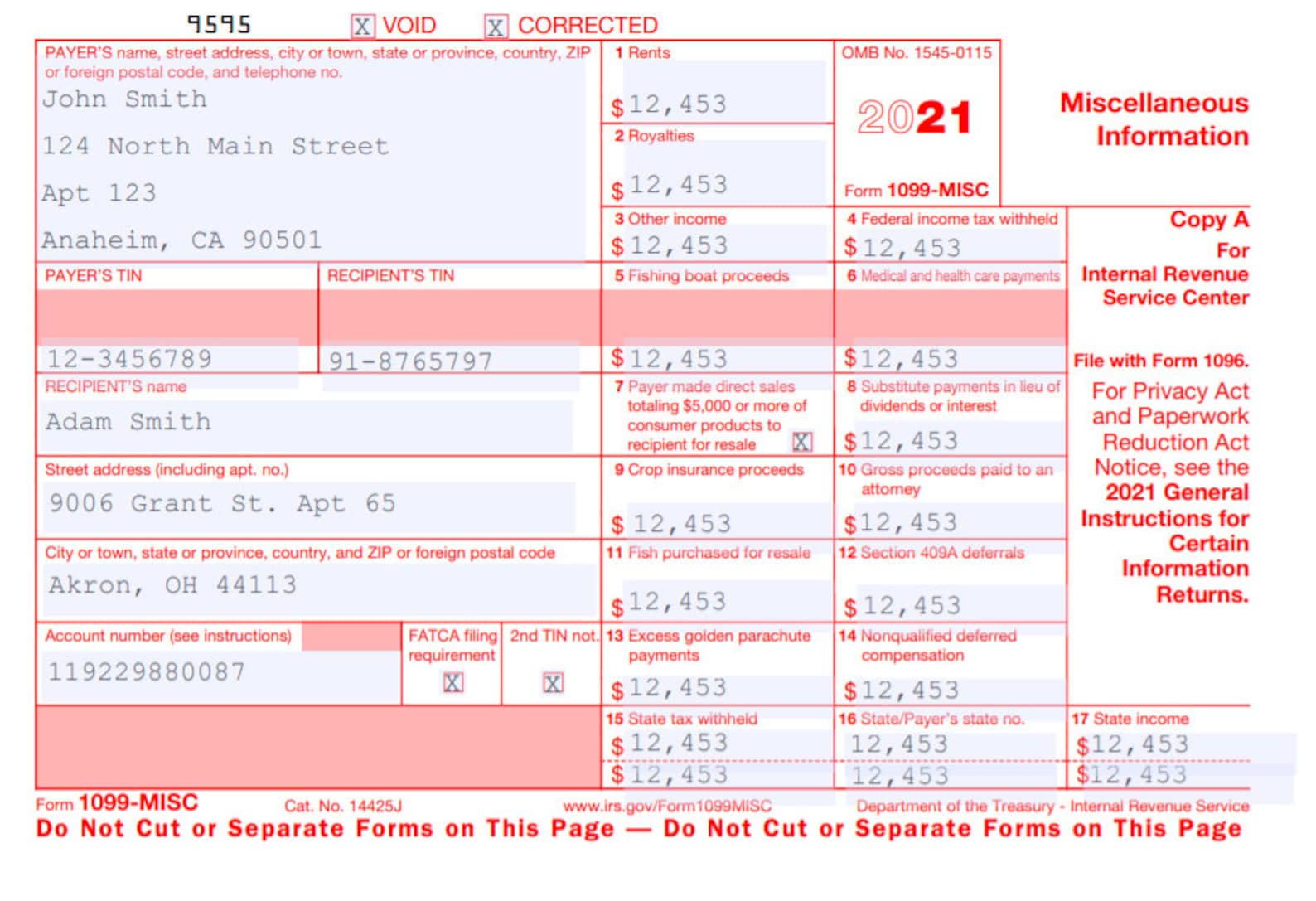

1099Misc Printable Form

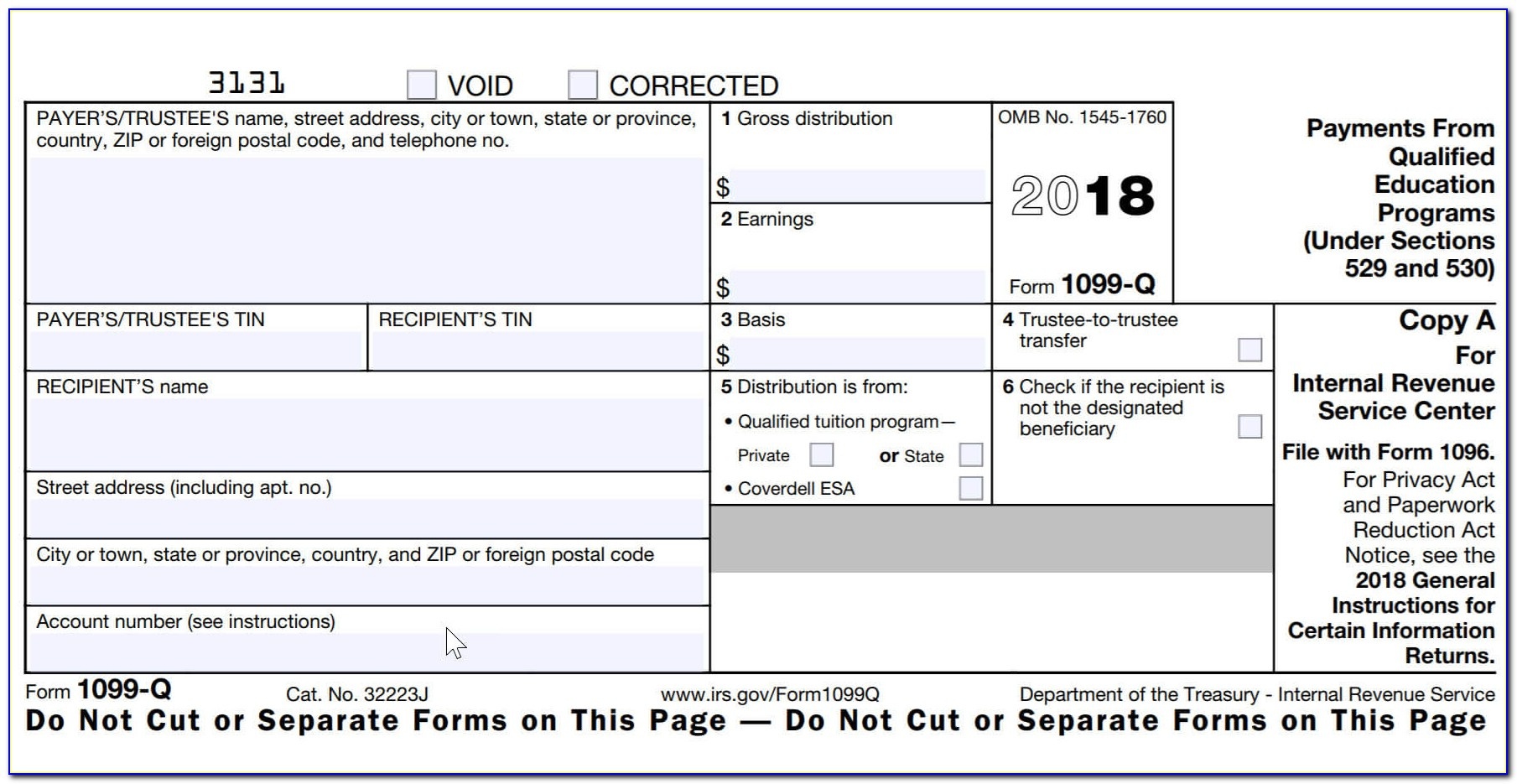

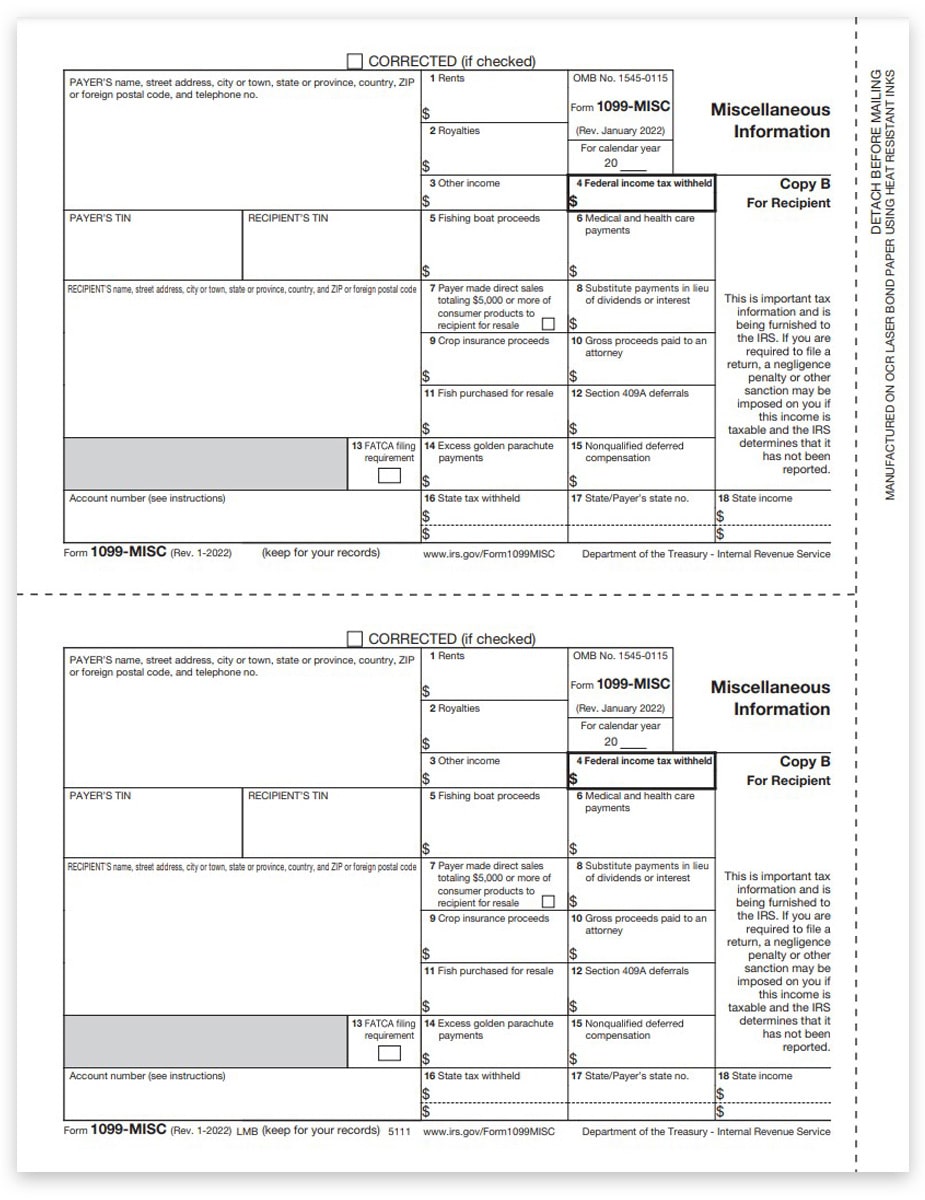

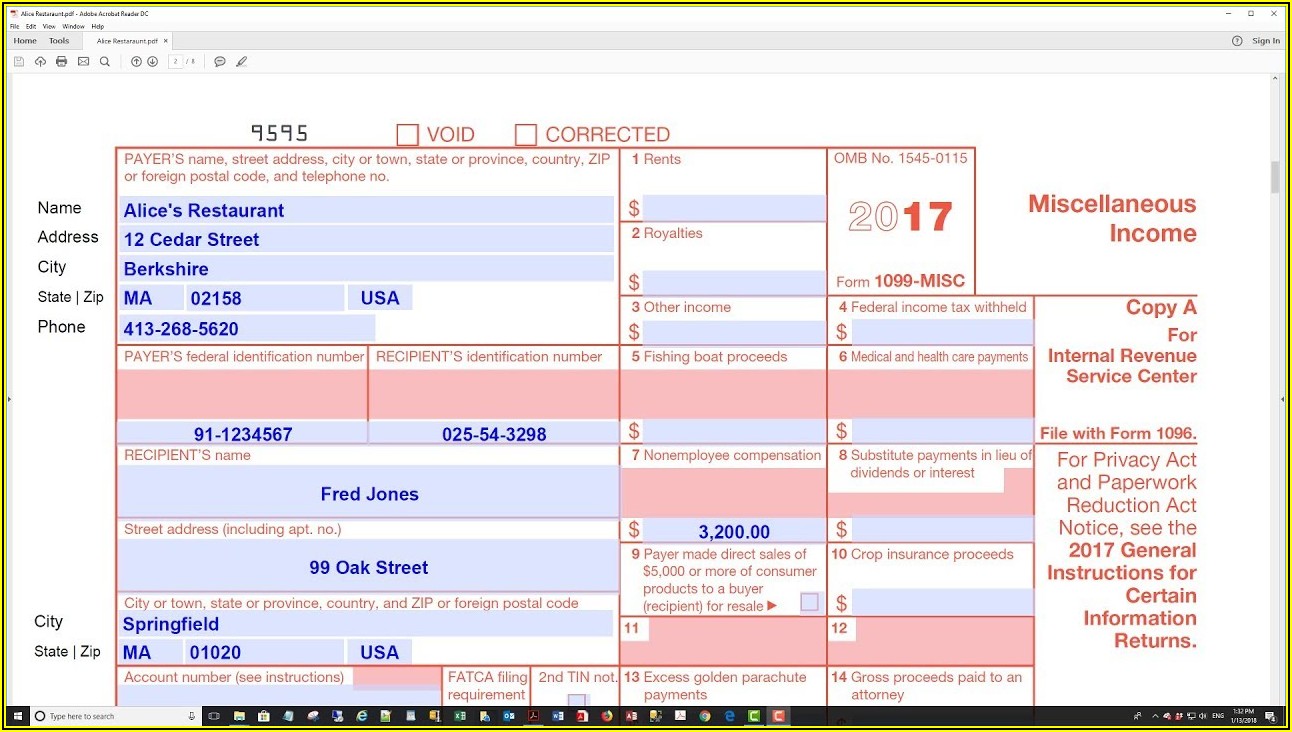

1099Misc Printable Form - These documents are in adobe acrobat portable document format (pdf). The following forms are available: Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Each 1099 form has specific boxes for distinct types of payments. Illinois department of revenue returns, schedules, and registration and related forms and instructions. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Fill out the miscellaneous information online and print it out for free. This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. Go to www.irs.gov/freefile to see if you qualify for no. Illinois department of revenue returns, schedules, and registration and related forms and instructions. The following forms are available: Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Go to www.irs.gov/freefile to see if you qualify for no. Each 1099 form has specific boxes for distinct types of payments. These documents are in adobe acrobat portable document format (pdf). To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. Fill out the miscellaneous information online and print it out for free. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Fill out the miscellaneous information online and print it out for free. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Each 1099 form has specific boxes for distinct types of payments. Our guide describes the basics of the nearly two dozen different 1099 forms used to report. These documents are in adobe acrobat portable document format (pdf). Beholden to their own tax reporting requirements and file their own tax returns. The following forms are available: Each 1099 form has specific boxes for distinct types of payments. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Fill out the miscellaneous information online and print it out for free. Go to www.irs.gov/freefile to see if you qualify for no. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Fill out the miscellaneous information online and print it out for free. Beholden to their own tax reporting requirements and file their own tax returns. This page allows state of illinois vendors to view and print copies of 1099 forms. This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. These documents are in adobe acrobat portable document format (pdf). Fill out the miscellaneous information online and print it out for free. Our guide describes the basics of the nearly two dozen different 1099 forms used to. Fill out the miscellaneous information online and print it out for free. Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. The following forms are available: These documents are in adobe acrobat portable document format (pdf). Go to www.irs.gov/freefile to see if you qualify for no. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Beholden to their own tax reporting requirements and file their own tax returns. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. These documents. The following forms are available: Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. Beholden to their own tax reporting requirements and file their own tax returns. Illinois department of revenue returns, schedules, and registration and related forms and instructions. These documents are in adobe acrobat portable document format. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. Illinois department of revenue returns, schedules, and registration and related forms and instructions.. Go to www.irs.gov/freefile to see if you qualify for no. This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. Illinois department of revenue returns, schedules, and registration and related forms and instructions. Beholden to their own tax reporting requirements and file their own tax returns. Business. This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. Beholden to their own tax reporting requirements and file their own tax returns. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Each 1099 form has specific boxes for distinct types of payments. These documents are in adobe acrobat portable document format (pdf). Fill out the miscellaneous information online and print it out for free. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. The following forms are available:1099 Misc Free Fillable Form Printable Forms Free Online

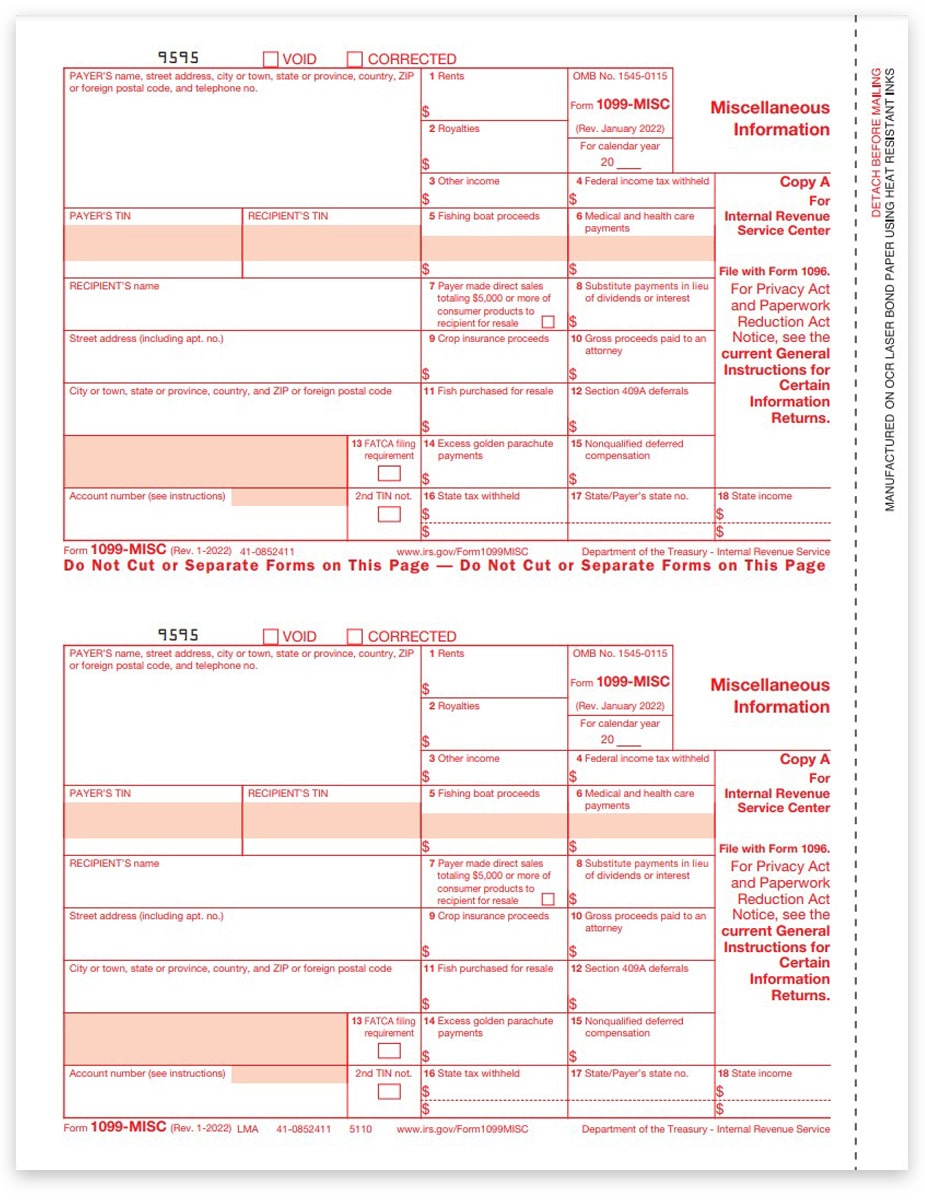

1099 Misc Printable Form 2022

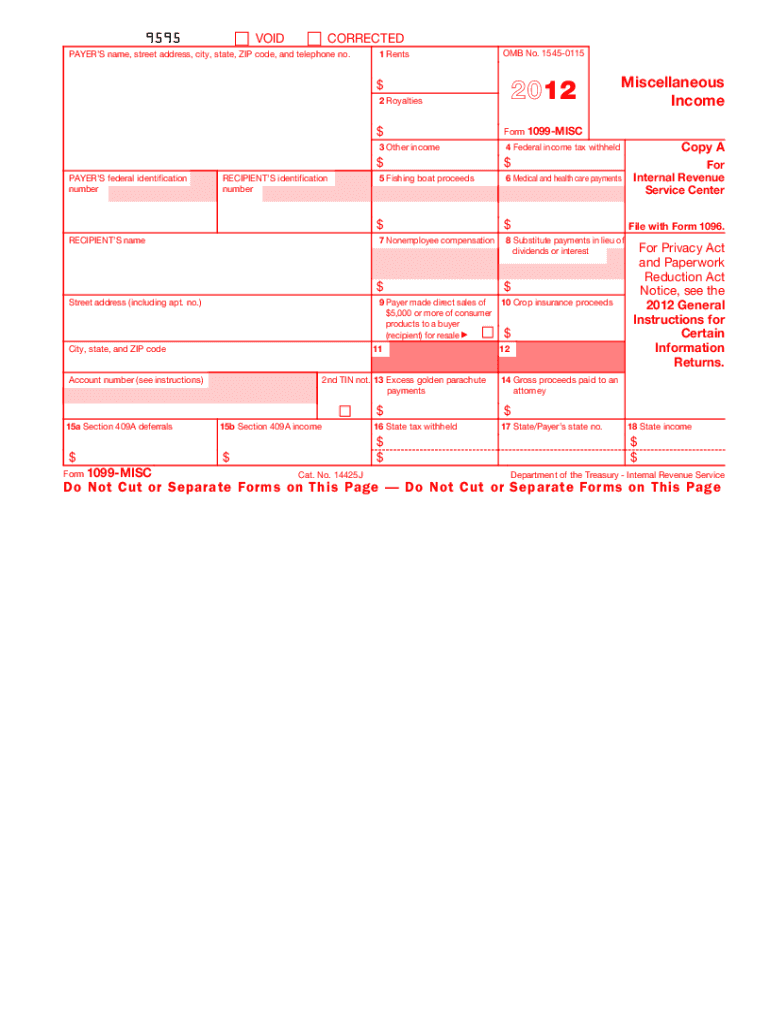

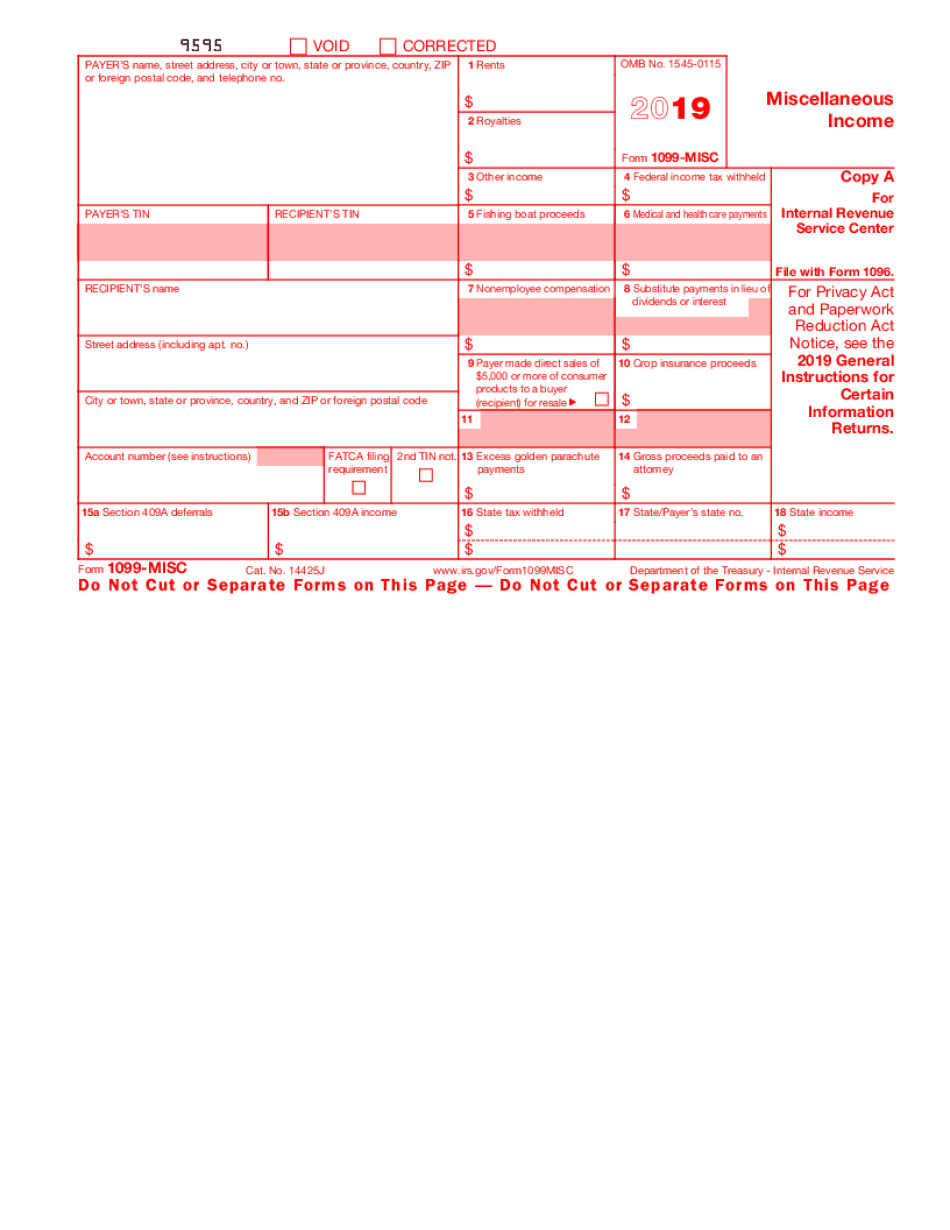

1099 Misc Form Template

1099MISC Form Printable and Fillable PDF Template

Printable 1099 Misc Forms

Printable 1099 Misc Form 2023 Printable Forms Free Online

1099 Misc Forms Printable

1099 Misc Printable Form 2023

Printable Form 1099 Misc

1099 Misc Printable Form

Go To Www.irs.gov/Freefile To See If You Qualify For No.

Illinois Department Of Revenue Returns, Schedules, And Registration And Related Forms And Instructions.

Our Guide Describes The Basics Of The Nearly Two Dozen Different 1099 Forms Used To Report Income To The Irs.

Related Post: